Personal Finance

Do We Need Health Insurance?

“Who is your health insurance through?” “What do you mean you don’t have health insurance?” “Your husband is an attorney, he should have health insurance through work”. More often than not this is the start of my conversation with friends interested in learning about our health insurance. About a year ago, my husband was promoted to partner at his law firm. While we were celebrating, we learned partners are no longer employees and we would no longer have our employee sponsored health insurance. We had an option to continue to pay for the insurance but after seeing it was [...]

Anxiety, the Last Hurdle Before Financial Freedom – Part 1

Severance Update In my last post, “No Power, No Water, No Heat, No Severance'' we were in the middle of a cold front that left us without electricity, water, and internet. This delayed all of my corporate work communications and the following week when the essential services came back online I received word on my severance request and... It was accepted. I am now twice retired, and can focus on HIT, family and friends. Financial Independence It has now been 3 months since retiring and financial independence has been everything I dreamed it to be. But before I share more [...]

Financial Independence is Here! My Reflections On How The Journey Began

In August 2020, Sarah and I met our financial goals. We reached “enough” and will begin forging a new path, not driven by money. The financial independence journey took me 37 years to accomplish and over half of those years I spent in the passenger seat. This post is about my early days and is dedicated to family, friends and mentors who started me down the path to financial freedom. A collage of mentors from top left to bottom right. Uncle Chuck and myself on the farm, Grandpa and I on Memorial Day, Grandma shucking corn with George, Mom [...]

2019’s Lifestyle Altering Bike vs. Ride Challenge

2019 was a lifestyle altering year where I committed to bike more than I drive. The seed was planted in 2017. We moved from the Four Corners to Houston Texas, purchased a home, flooded and re-built. Due to Hurricane Harvey it took us longer than expected to settle into a normal routine, but when we did I soon realized how much I missed the regular occurrence of outdoor adventures with nearby and active friends. It wasn’t long before my mind was racing on ideas to fill the gap. The quick and easy answer was to sacrifice family time and go [...]

The Best 2020 Cash Back Credit Card for Savers

Christmas and the gift-giving season is usually here faster than we expect. As you begin shopping for yourself and others, we want you equipped with the best credit card on the market. There are many choices for each financial lifestyle stage (borrower, spender, saver) and reward goal (cash savings, college savings, travel, debt transfers) but at HIT our focus is on savers and cash back. There is plenty of competition in the credit card market, which is a benefit to the cardholder who can seek out the best deal (or finish reading this blog post, hehe). The competition has led [...]

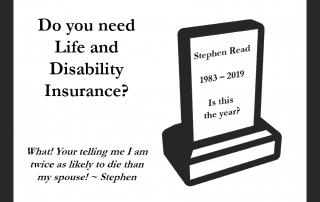

I Have More Than Double The Likelihood of Dying As My Wife! Should I Buy Insurance?

Death and Disability - What’s in your future and should you buy insurance? I have a 1 in 2700 chance of dying this year, and my wife’s odds are 1 in 5900. If 1 in 2700 wasn’t sobering enough, being at the luxurious age of 35 I have a 50% chance of becoming disabled for 90 days or more before turning 65. I find it easier to ignore the data and go on living with my head in the sand but in reality, I need the data to remind me of how life on earth is temporal and does not [...]