Death and Disability – What’s in your future and should you buy insurance?

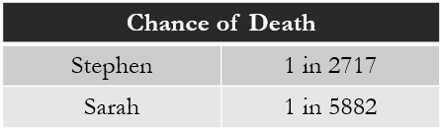

I have a 1 in 2700 chance of dying this year, and my wife’s odds are 1 in 5900.

If 1 in 2700 wasn’t sobering enough, being at the luxurious age of 35 I have a 50% chance of becoming disabled for 90 days or more before turning 65. I find it easier to ignore the data and go on living with my head in the sand but in reality, I need the data to remind me of how life on earth is temporal and does not always go as planned.

(Find your death stats here. Look for your associated column and row, and divide 1 by the number you find)

Planning for the unexpected can be worthwhile, especially when the “unexpected” is really “a statistically significant probability” and in the category of catastrophic and life-changing events. Financial planning for the unexpected is a must. The preparation could come by means of an emergency savings account, investments, or insurance.

My preference is savings and investments, but those take hard work and for most of us, time. So if you are not able to self-insure yet, you may need auto, health, life, home, and or disability insurance. I’ll focus in on death or disability insurance in this article and the associated question of whether you should carry them.

In general, as an avid saver, you should struggle with adding additional expenses that slow your ability to be self-insured and more specifically, financially independent. Since insurance is an expense, and private insurance companies exist to make money, the odds are against you and you should only purchase insurance when there is a need.

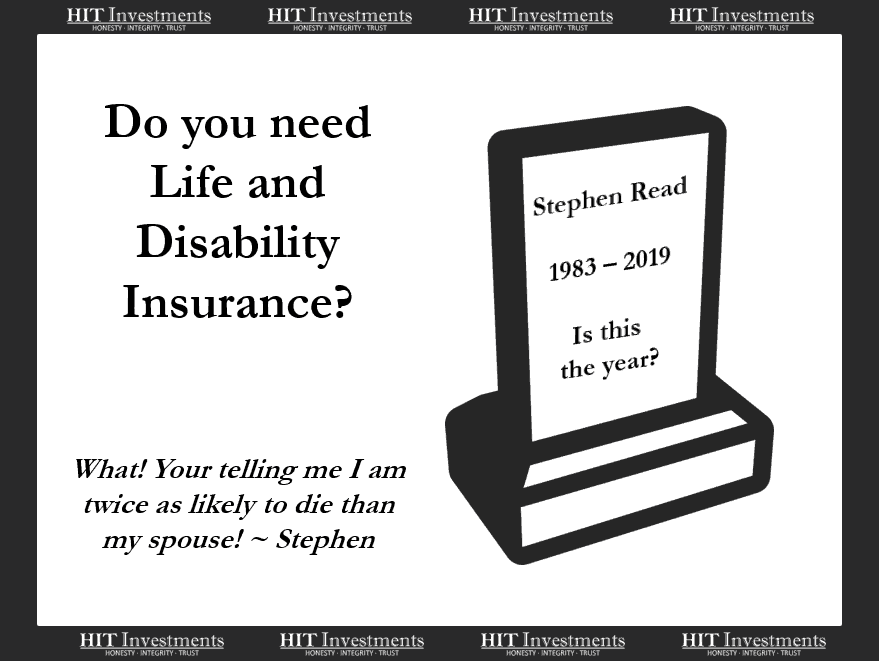

This need is based on the people around us. If you were to die or become disabled, how would the lives of those who depend on you change? Forewarning, the conversation and thought process you need to go through may be disturbing. When forcing yourself to think through the ugliness of death or disability, remind yourself of why and who you are doing it for.

Starts With Conversation

I’ve been married for 9 blessed years. It wasn’t until my parents pressured me into purchasing life insurance after our first child that Sarah and I began to discuss what would happen if either one of us died or became disabled. The discussion wasn’t fun, but there were some perks of having gone through it.

For instance, I learned Sarah wouldn’t mind going back to work after the kids were in school and she learned that I would be willing to quit my 8-5 job if she was to go to the Lord. The scenario that was most difficult to discuss as if we were both to die. The thought of not being around to raise our children or having to take care of my spouse while raising children changed both of our decisions.

Run the Numbers

Part of the conversation involves running the numbers. We started with estimating our annual spend, using a free web service called Mint. Mint is an online budgeting tool that can evaluate your historical spending habits and you can use that to estimate future expenditures. (If you are not currently tracking expenses or budgeting, I highly recommend starting with an electronic aggregation service like Mint.) Using Mint, we estimated our needs to be about $70,000/yr to continue our current lifestyle.

Recovery Time

Once we had our annual expenses, we estimated how long it would take for one of us to get back on our feet if the other had passed away or become disabled. This came from our honest discussion of what our lives would look like under the possible death and disability scenarios.

Our frugal lifestyle and education came in handy here. We are a dual engineer degreed home (actually triple as my wife has two engineering degrees) and if I were to pass away, we believed Sarah could find a job in less than a year once she committed to it. I was already earning and could keep doing so if needed.

Thus, we estimated our recovery time at 3 years. This would allow us enough time for our kids to start full-time elementary school and would give Sarah a year to find a full-time engineering job.

The Answer

Once you have the conversation, calculate your spend, and figure the time needed to get back on your feet, you can estimate the amount of savings or insurance you’d need.

For us, we needed $210,000 or $70,000/yr for 3 years. Since we had this much in savings, and I have a free life insurance plan through work we decided to pass on purchasing more life insurance and are going the self-insured route.

The Unforeseen

Sometimes you miss something. It happens. When we first had our conversation, we didn’t consider that one of us would be significantly disabled or that both of us would be dead. So we had to start the process all over again, accounting for each scenario. The thought of not being around to raise our children or having to take care of my spouse while raising children did adjust our final decision. If both of us should pass, we had to choose caretakers for our children. This did not adjust our self-insurance decision.

However, one or both of us being significantly disabled, and generating significant medical expenses, was a game-changer. The thought of tens of thousands of dollars of medical expenditures, year over year, frankly scared us. So we decided to purchase disability insurance to help out with some of the unforeseen expenses if one of us becomes a long-term financial burden.

I didn’t appreciate when my parents applied pressure for us to buy life insurance 4 years ago but I am appreciative of it now. I learned a lot about my wife through the process that I wouldn’t have otherwise known, and I think we are mentally and financially better off for it.

Hurricane Harvey showed us both that when under significant amounts of stress, it is harder to think rationally, thus we have a deeper understanding of why we should continue to plan for the unexpected.

Do you have people financially depending on you? Did you choose life or disability insurance?

Are you working towards financial independence, if you haven’t already joined our newsletter, “Where Savers Go to Grow” do so here 🙂

References

2019 Mortality Table

https://www.irs.gov/pub/irs-drop/n-18-02.pdf

Disability Facts

https://www.affordableinsuranceprotection.com/disability_facts

Leave A Comment