In August 2020, Sarah and I met our financial goals. We reached “enough” and will begin forging a new path, not driven by money. The financial independence journey took me 37 years to accomplish and over half of those years I spent in the passenger seat. This post is about my early days and is dedicated to family, friends and mentors who started me down the path to financial freedom.

A collage of mentors from top left to bottom right. Uncle Chuck and myself on the farm, Grandpa and I on Memorial Day, Grandma shucking corn with George, Mom on a lunch run, Dad and myself at the workbench, Josh Merdian showing me how to prepare my steer for the fair, Uncle Chuck, Grandma, Dad and Aunt Lori at our harvest celebration, my 4-H club the Saratoga Leadaways, my sisters, cousins, and I shucking sweet corn.

The Beginning

In 1983 I was born in Peoria, Illinois, a small city on the Illinois river 45 minutes south of our family farm. The farm is where I grew up and for 20+ years I was taught to earn my way, save my earnings and invest for the future. These traits did not come naturally nor were they emphasized in my traditional public education upbringing.

Photos of the farm by Katie Knapp, the Ag Photographer*

Hard Work, Building Career Capital

They made buckets bigger in the 80’s

By the end of age 8 I learned farm work wasn’t always fun nor was it easy. A typical day entailed waking up before dawn, running when others walked, and learning how to do and fix things with what we had available. The list of to do’s were ever growing and ranged from simple to awful. (In my opinion the worst job was cleaning the corn crib.) There was more work than time permitted, but the harder I worked the happier Dad, Mom, Grandma and Uncle Chuck seemed to be.

Taking soil samples to check for nematodes

So as I learned to work hard, I simultaneously began to build farm skills aka “career capital”*. My earnings started with a weekly allowance ($2) paid by my parents, but additional money started to come in by doing odd jobs for neighbors, selling garden vegetables to the local grocery store and peddling snacks in town. On the farm, if you saw a need, you were expected to fill it. Off the farm when I filled needs, sometimes people paid me for it.

Budgeting, Marketing, Failing

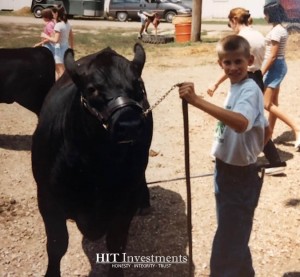

My feeder finance calf and I at the Marshall-Putnam Country 4-H fair.

My first active investment opportunity was in junior high where I joined the 4-H Beef Feeder Finance program. Feeder finance taught me how to invest, budget, fatten, and market cattle. I competed for 6 years in this program and did well, even winning the contest once. But the primary lesson I learned wasn’t budgeting, caring for an animal, marketing, or investing. It was that hard work doesn’t always pay off. The most profit I made on feeding out 2 calves each year was $129, and some years I lost money. This profit included using the farm’s facilities for free and valuing my time at $0/hour. The learning wasn’t immediate but after 6 years I learned feeding calves was currently not a good business for me.

Investing, Compounding

Dad imparting some investment wisdom…. or sharing a few more chores to do

While I worked hard at breaking even with my calves, dad helped me open my first investment account, a Roth IRA at Vanguard. I had no interest in investing at the time but when dad turned it into a competition, my view flipped. Growing up I rarely beat dad at anything and if I did, it was a game of luck or my teammates carried me to victory. So when he explained I could pick four investments that may have done better than his actual investments over the past four years, I was vested and itching to research. Dad taught me how to locate investment costs and he introduced me to independent research like Dan Wiener’s Vanguard Advisor.

So I picked four mutual funds with low expense ratios, I thought were cool, and were recommended by Dan’s newsletter. One mutual fund I chose was a European index fund that tripled in value over the competition’s four year timespan. This fund alone carried me to victory over my dad on the investment challenge.

Risk, Diversification

After the competition I invested my Roth money in multiple Vanguard funds. Dad shared the risks involved with investing and the reasons to diversify. He explained the European index fund’s gains were not typical and that I should not expect them to continue. I was hesitant at the time to take his advice but was happy I listened when the European index fund that was my hero in the competition was a loser the next four years, at one point it was down -62%.

Life Lessons

The farm taught me how to work hard, raising calves taught me to work smart, and the investment competition taught me how to compound my savings. Learning these concepts early on in life dramatically shortened my path to financial independence.

Sarah, Kona (our dog), and I in Park City, Utah preparing for the Financial Olympics.

Friends and Family

As I continue to take time to reflect on my past, I continue to learn from you. I now have three young children (4,4,6) and my parental instincts are to protect and ensure they succeed in every step of life, but as I learned on the farm, tough love, hard work and failure is important too.

Sarah, Isaac, Dad, Marcus, Nora and I enjoying the 2019 harvest.

Thank you for showing me the ways of life, supporting my unprofitable livestock endeavors, and teaching me how to invest. You are the foundation of HIT Investments and the basis for our financial independence. We wouldn’t be where we are today, without you.

More Information:

*The beautiful and recent photos in this post were crafted by Katie Knapp, The Ag Photographer. She is one of my 4-H colleagues and an expert in educating the world in where our food comes from. You can find her here.

*career capital is explained further in Cal Newport’s book So Good They Can’t Ignore You. Cal clarified what I am looking for in my perfect job, and what I want when money is not of concern: impact, flexibility, and control.

I enjoyed reading your article and seeing all the family photos. That is such an awesome achievement! I am happy to hear you and your family are doing well.