“Who is your health insurance through?”

“What do you mean you don’t have health insurance?”

“Your husband is an attorney, he should have health insurance through work”.

More often than not this is the start of my conversation with friends interested in learning about our health insurance.

About a year ago, my husband was promoted to partner at his law firm. While we were celebrating, we learned partners are no longer employees and we would no longer have our employee sponsored health insurance. We had an option to continue to pay for the insurance but after seeing it was ~$2,000 a month, we knew this wasn’t a long term solution.

Health Insurance Options

There must be other options. Could we find our own cheaper health insurance? Should we drop health insurance altogether? Maybe we could save that money and self insure ourselves? Should we look into the medical cost sharing plans that I’ve heard a couple of my pastors at church speak about?

The more we researched and compared insurance plans the more I became aware of the cost difference between “insurance” and “cost sharing”. It was hard to believe how much money we’d save with a cost sharing plan.

Naturally our focus turned to exploring the different health care cost sharing plans. All of them seemed to be much cheaper than insurance. The cost sharing plans were 50-65% less than private and federal government’s insurance plans. (We found there was not a big difference in cost between our private insurance and one we could buy on our own.)

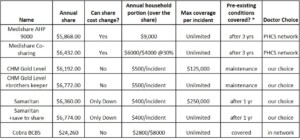

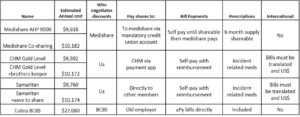

My brother, Stephen (the HIT-man) and his wife Sarah went through a similar process when he retired. Sarah built off of our preliminary research and put a chart together to compare the different medical sharing plans. The two charts below are a small snapshot of all the information she gathered.

Estimated Annual Cost was based of 10 sick visits and 5 Annual Physicals with Preventative screening

(This is a very condensed version of the information Sarah gathered, so please use this only as a starting point if you are making a decision for your family.)

There seemed to be three options: No insurance, expensive insurance, or cost sharing. Cost sharing was a brand new concept to me, so I’ll dive into what it is and why it became a feasible option for us in my next post.

This is probably about the time you are thinking about what to do with your own health insurance, or possibly considering alternatives. If you are interested, keep a lookout for part 2. If you aren’t signed up for our email blast, you can sign up here.

Leave A Comment