Investments

Congratulations on navigating to our investment page. These blog posts were written and are dedicated to your willingness to sacrifice today for a better tomorrow.

The Mailbag: CAPE Ratio, Hard Money, and Bridge Loans

One of the many benefits of writing a blog is the challenge of organizing your thoughts and having them questioned. It’s initially scary to put it out there, but as time passes there is a subtle switch from scary to educational. Our interactions have developed into a mutually beneficial relationship of learning. We rarely all agree on financial topics like the efficient market, behavioral finance, and saving till you are blue in the face. However, your rebuttals, comments, and suggestions expand and test my own understanding, which in turn creates better articles and mailbags. So, without further ado, our latest [...]

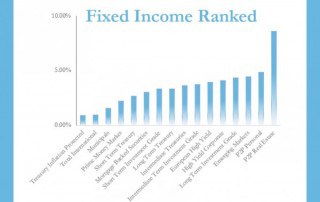

16 Fixed Income Classes Ranked Based On Returns

I loaded up our HIT Investments fire box and got the research train rolling. Aggregating data from 14 fixed income classes, ranging from international high yield bonds to domestic short-term treasuries, was like shoveling coal: difficult, but necessary.

Peer to Peer Lending – The Investor’s View

Financial innovation has opened a new and more efficient avenue to connect investors with borrowers. One of the technologies evolving since the mid 2000's has been the Peer to Peer (P2P) marketplace. Since their inception a decade ago they have grown from $0 to $54 Billion.

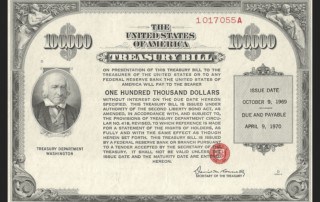

The Story of the T-Bill: Safe Investments Often Lead to Real Losses

When studying finance in preparation for the Series 65 exam there was an emphasis on specific investment objectives. The "safest" investment objective was "Preservation of Capital" and its primary goal was to prevent loss. Preservation of capital investments includes Treasury Bills (T-Bill), certificates of deposit (CD), savings accounts, and money market accounts (MMA). These holdings are classified as the “safest” investments and are often insured against absolute loss. In industry lingo, they generate a “risk-free” rate of return. But before we take it as so, and solidify the link between "Preservation of Capital" and "risk-free" in our brains, let's see [...]

33 Countries Ranked by Value

Benjamin Graham, the forefather of fundamental value investing once taught Warren Buffett, “Price is what you pay. Value is what you get”. Since Benjamin Graham wrote Security Analysis in the 1930’s, more academics, quantitative analysts, and Warren Buffett, have made strong cases that value investing outperforms the general market over the long term. In one example, Buffett’s firm Berkshire Hathaway employs value investing, and their track record outperformed the S&P 500 by 1,586,929% over the last 51 years. (1964-2015 Berkshire Hathaway gained 1,598,284% while the S&P 500 gained 11,355%) As we like to build upon our predecessor’s learnings, HIT Investments [...]

Value vs. Price: The Difference is Very Real

Our natural human condition is to know and communicate the price of a product while ignoring the product’s value. Oscar Wilde once said “Nowadays people know the price of everything and value of nothing.” This is a fundamental flaw in how we think and it has played a part in strengthening the consumerism culture we live in today. An everyday example of a marketer taking advantage of this flaw is the marking up of an item by 50% to only then place it on sale for an equivalent 50% off. If we were a value based society, that would be [...]