Our natural human condition is to know and communicate the price of a product while ignoring the product’s value. Oscar Wilde once said “Nowadays people know the price of everything and value of nothing.” This is a fundamental flaw in how we think and it has played a part in strengthening the consumerism culture we live in today. An everyday example of a marketer taking advantage of this flaw is the marking up of an item by 50% to only then place it on sale for an equivalent 50% off. If we were a value based society, that would be an ineffective strategy because we would know that the item was not truly on sale; but since we are naturally price focused we are tricked into thinking there is a deal to be had.

Awareness of our flaw to think in terms of price instead of value can not only help us live below our means, but it can also help us become better investors. If a stock drops 10% as a T-shirt in a retail store could, is the stock on sale? Should we purchase it? Our answer depends on the stock’s intrinsic value and not its price.

Intrinsic value is the actual value or the value that is justified by the facts. In beginning to determine the value of a business you need two key metrics: the business’s earning power and cost of ownership. Earning power is how much money the business makes and the cost of ownership is the measure of a company’s entire value, which in financial terms is also known as enterprise value.

The following is an example of two landlords looking to purchase a rental property. One landlord uses price to choose their home and the other use value.

Price Based Landlord

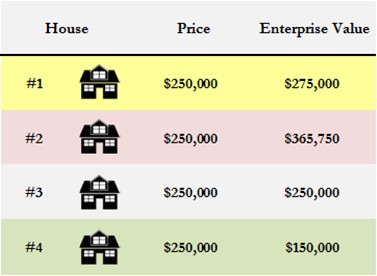

The price based landlord finds four structurally identical houses in the same subdivision that will all net about $1000/month in rent. Coincidentally house #1, #2, #3, and #4 are priced at the same point, $250,000. Since they are all in the same area, structurally identical, net similar rent and are priced the same, in the essence of time, the landlord chooses to purchase house #1.

Value-Based Landlord

The value-based landlord learns the same information on houses #1-4 as the price based landlord. Rather than stopping the analysis, the landlord performs further research and learns that house #1 comes with a $25,000 lien owed to a prior roofing contractor. House #2 is free of liens but has a man named Jimmy living in the basement. Jimmy proves that he owns the basement and that the $250,000 purchase price only includes the above ground floors or 66% of the house. A bit disappointed in the results, the landlord moves on to researching house #3. House #3 is free of liens and the price is for the entire house. Before becoming emotionally attached to #3 the landlord decides to research house #4 in case it is a better deal. The landlord finds that house #4 is free of liens, includes the entire house, and contains a safe full of $100,000 cash.

The value-based landlord takes the research and compares the four houses before making a decision. Since the earnings or rent from each house is the same ($1,000/mon) the landlord focuses on the cost of ownership, or in financial terms, each house’s enterprise value.

The landlord reviews his information and decides to purchase house #4 for $250,000 because it has the lowest cost of ownership.

The price based landlord took on the risk of having to pay an extra $25,000 to remove the previous owner’s lien owed to the roofing contractor while also missing out on a free $100,000. By pure chance, the price based landlord avoided purchasing house #2 which would have only netted 66% of the house and decreased his rental income abilities.

The value-based landlord learned that the purchase price for each house was exactly the same while the cost of ownership ranged from $365,000 to $150,000. The cost of ownership, or enterprise value, of house #2 was over twice as much as house #4 where the landlord received $100,000 in closing on the house. In this instance, the intrinsic value of house #4 was much greater than house #1, #2 and #3 because the cost of ownership was much less for the landlord to acquire the same amount of rent.

One of the first steps HIT Investments takes when analyzing businesses to invest in is to calculate the enterprise value and associated earnings. Our end goal is to spend less to earn more, just as the value based landlord did.

Working to purchase investments below their intrinsic value, or as Warren Buffet and Charlie Munger say “margin of safety,” is one way we can lower our risk while increasing our returns.

Price cut photo was taken by Craig Murphy and modified by HIT Investments

Hey there, You have done a fantastic job. I will definitely digg it and personally suggest

to my friends. I am confident they will be benefited from this

web site.