Lately, I’ve found myself devoting more hours than ever to social media platforms like Facebook, LinkedIn, and Twitter. Sharing my opinions, connecting with colleagues, and even lending a helping hand to friends and strangers alike. What starts out as a genuine effort to engage and contribute sometimes snowballs into something else entirely. I’ll glance at my clock, only to realize that what felt like a quick check-in has turned into one or two hours, swept away by algorithm-driven videos and the endless scroll of trending topics. It’s in those moments, as I snap back to reality, that I’m reminded just how easy it is to surrender an hour of precious time without even noticing. I get upset at myself for losing an hour and can only imagine how pissed I’d be if I lost an entire decade.

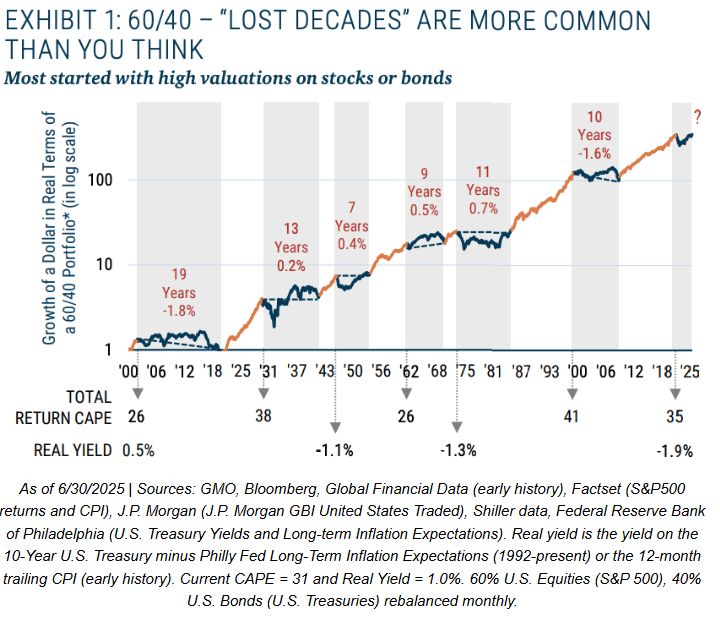

Recent research indicates that investment portfolios have “lost decades” 6 times in the last 100 years. These lost decades are prolonged periods in which the traditional 60/40 investment portfolio (60% U.S. equities, 40% U.S. bonds) fails to deliver inflation adjusted returns. The chart below highlights multiple historical periods (1900–2025) where 60/40 portfolios experienced extended stretches of flat or negative real growth, often starting with high valuation levels on stocks (CAPE above 26, or bond yields below inflation).

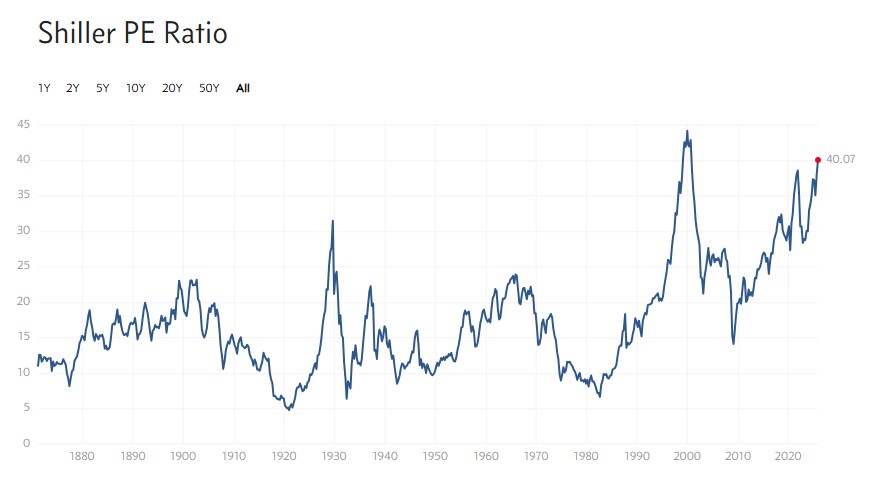

Current State: CAPE (Shiller PE) is 40 and Real Yield is 1%

1910–1929: 19 years yielded a cumulative real return of -1.8%.

1929–1942: 13 years, +0.2% annualized.

1942–1949: 7 years, +0.4%.

1968–1977: 9 years, +0.5%.

1977–1988: 11 years, +0.7%.

2000–2010: 10 years, -1.6%.

2025 – 2035: real return estimates for the S&P 500 based on CAPE is -2% and real yield is 1%.

These “lost decades” occurred during periods with elevated CAPE ratios and/or low real bond yields, similar or better than today’s market conditions.

Potential implications for traditional investors and advisors:

Risk of Stagnation: Extended periods of low or negative real returns may reoccur, especially given currently high equity valuations (CAPE = 40) and low real yields (1.0%).

Domestic Diversification Alone Is Not Protection: A domestic balanced portfolio may suffer when both stocks and bonds are highly valued.

Planning for Volatility: Investors should be prepared for the possibility of stagnating real returns, especially if future market conditions mirror historical precedent.

Recommendations

Review Your Portfolio: Assess your reliance on traditional 60/40 allocations; consider alternative strategies with better expectations in a high CAPE, low yield environment.

Scenario Planning: Run stress tests for portfolios under different valuation and yield assumptions to understand potential real return paths and how it will affect your life and financial goals.

Be Honest with Yourself: Ask yourself if you are on track or are being led astray by your own bias, maybe… recency bias, home bias, ambiguity bias, herd mentality, illusion of control, availability bias, attention bias, or overconfidence bias

Conclusion

Historical evidence suggests that “lost decades” in portfolio performance are not rare anomalies, but recurring features during periods that begin with high stock or bond valuations.

It’s up to us as a stacker to learn, plan, adjust and prepare.

Leave A Comment