We have many behavioral biases and the latest data shows that “home bias” is one of them. Home bias is where we invest more of our assets in the country and community we live rather than globally. Becoming aware of our biases, including our home bias, enables us to make more rational personal finance and investing decisions.

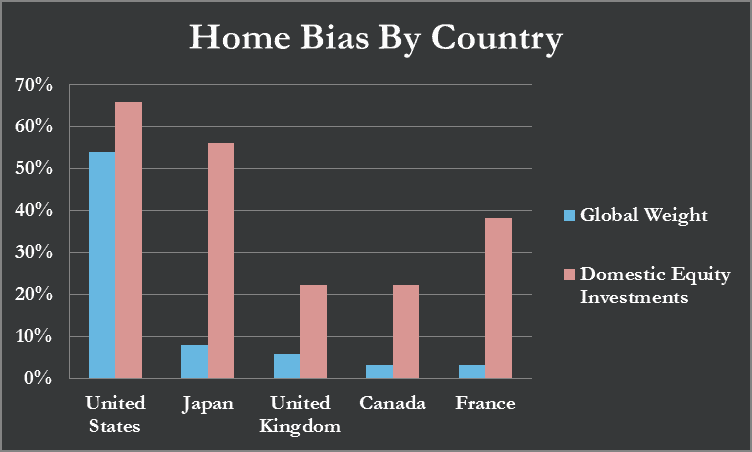

The IMF (International Monetary Fund) and MSCI All World Index gathered data from the five largest countries by market size. All five demonstrated a significant home country bias, rather than a global market cap weighted allocation.

Data as of December 31, 2015 is in U.S. dollars. Domestic investment is calculated by subtracting International Monetary Fund’s total foreign investment in a given country from its market capitalization in the MSCI All Country World Index.

America had the highest domestic equity allocation (66%) and global weight (54%). Japan had the largest home bias, having 56% invested at home while only holding 8% of the global market. So if you are part of the majority of us and are home biased (myself included), does that mean you should move more of your domestic investments into the foreign markets or is this bias a non-factor?

Let’s look into the reasoning behind having a global allocation. I consider the main benefit to be diversification, which used properly tends to reduce portfolio volatility. Unfortunately diversification is not always advantageous. Further complicating the issue here is that market capitalization is the measurement tool, which is solely price based.

Diversification in moderation is beneficial, but diversification in abundance dumbs down your portfolio and can even open yourself up to losses through ignorance. If you believe in EMH, Efficient Market Hypothesis, and believe you can eliminate costs and fraud, then diversifying and eliminating your home bias makes wonderful sense. I personally just don’t think this is totally rational.

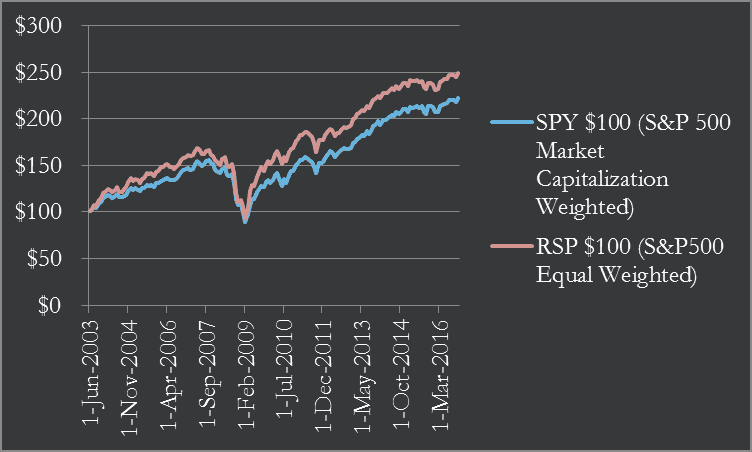

If you are skeptical of the EMH and strive to outperform the aggregate (like I do) then you need to dive deeper. Since market capitalization weighted diversification in essence is investing in the aggregate, your ability to outperform the aggregate is eliminated. The second issue is with the allocation being market capitalization weighted. As a true value investor it does not make sense to invest more in something just because the price went up (unless you’re talking about momentum, but we will leave that for another newsletter). When you are shopping and find out at the register your gallon of milk doubled in price, do you think “I better run back and buy another!” Absolutely not. The following chart shows you shouldn’t do that in the market either. When the S&P500 market capitalization weighted (SPY) is compared to the S&P 500 equal weighted (RSP), it has underperformed, even with RSP having a higher expense ratio.

Data for SPY & RSP sourced from Yahoo Finance. Chart displays growth of $100 beginning 6/1/2003 through 11/1/2016

Then, if you take your diversification further by trying to invest in literally everything you come across (true diversification) you open yourself up to being taken advantage of through inefficient investment products. (You no longer have a handle on what you’re investing in because you’re spread too thin).

So if you want to outperform but don’t want to become a victim, should you still diversify? Yes, but in moderation. Diversifying moderately allows you to make mistakes without the consequences of having to start completely over, and being human, mistakes are inevitable. (A personal example is investing in the bank Wachovia before the financial crisis, ouch!).

In conclusion, when you reflect on your personal portfolio, are you moderately diversified for the right reasons? Are your allocations home biased because of personal expertise, a tilt towards value, or an ability to minimize costs? Is your home bias driven by personal or moral reasons, maybe patriotism, community pride, or an inheritance? Or are you diversified for the wrong reasons: availability bias, overconfidence, herd mentality, or even an illusion of control.

If you find your portfolio allocations are diversified for the wrong reasons maybe it is time to think about updating your allocation strategy.

References:

International Monetary Fund

MSCI All World Index

Home Bias in International Equity Portfolios: a Review Piet Sercu and Rosanne Vanp´ee

Home Bias Re-Visited, Geert Bekaert and Xiaozheng Wang, Columbia Business School

The buck stops here: The global case for strategic asset allocation and an examination of home bias Vanguard – July 2016

Leave A Comment