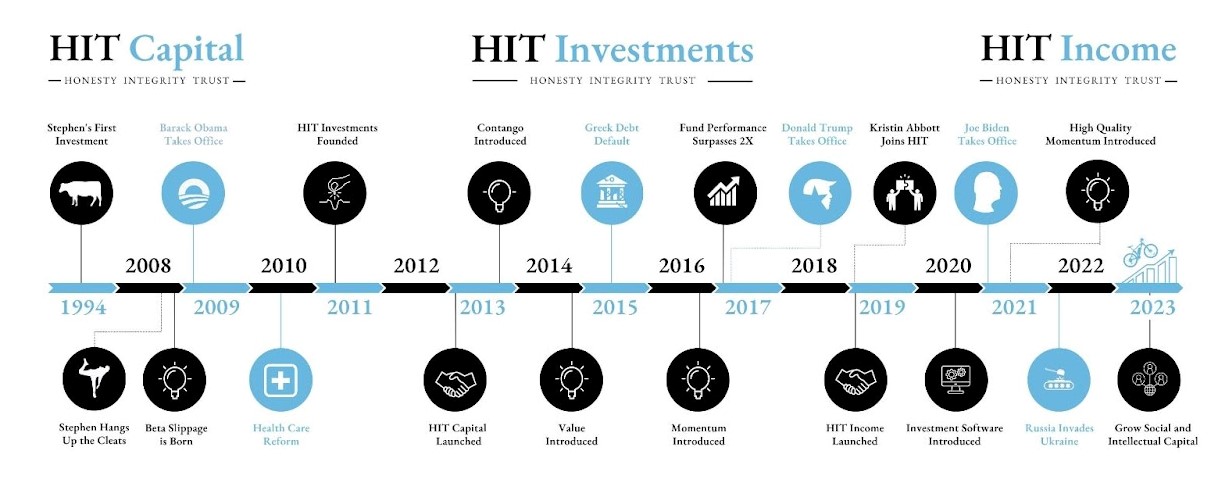

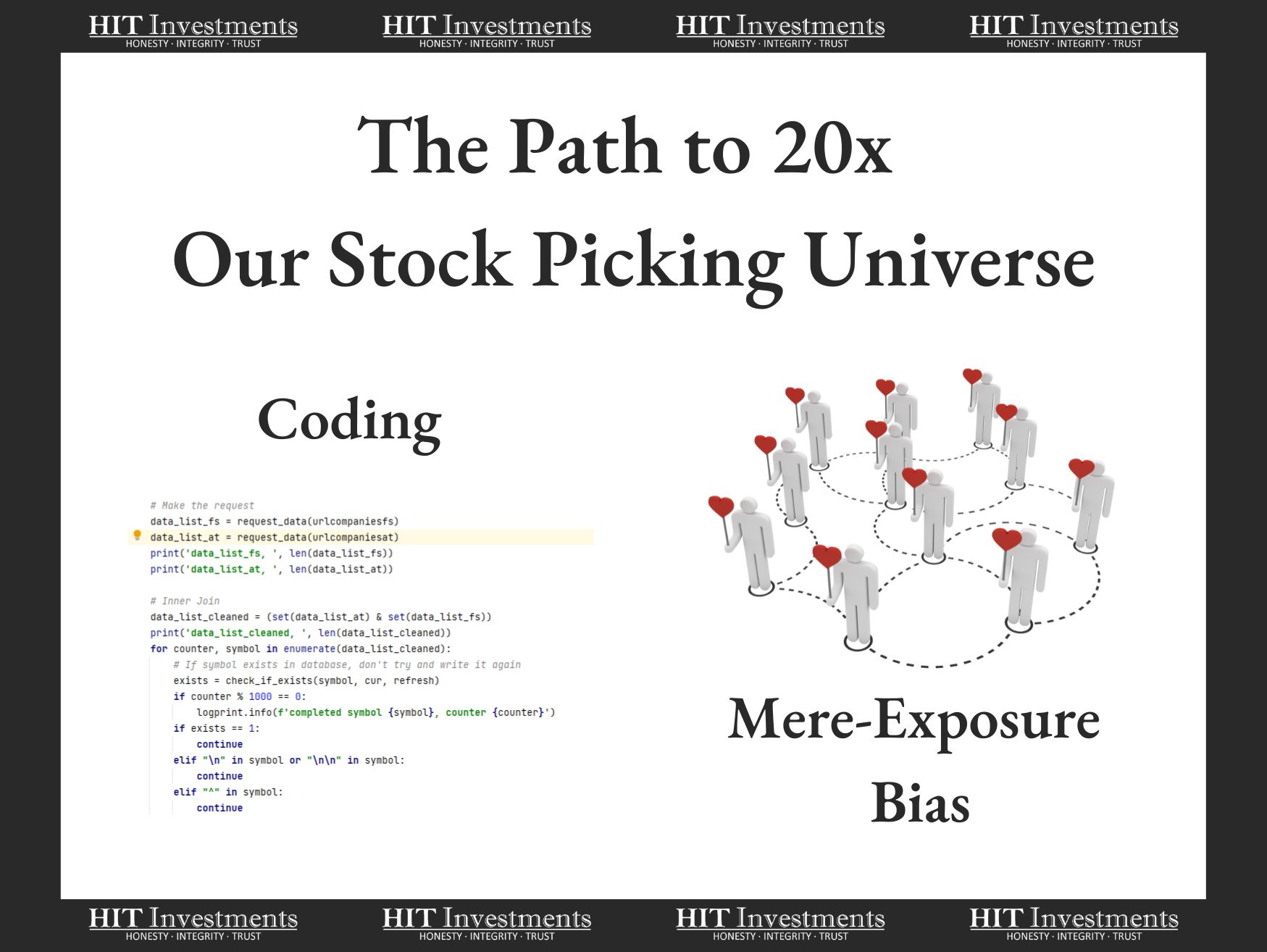

At HIT Capital, our stock picking process begins with filling the top of the funnel with as many stocks as possible. In 2014, I started value investing with data on 2000 stocks, and now nine years later we are up to 42,280. As I look back and review the path we took to get here, two primary and intertwined hurdles jump out, overcoming the mere-exposure behavioral bias and learning how to code.

In 2013, the subset of 2000 stocks I was using were the same ones utilized in most of the equity mutual funds and ETFs listed today. They are the largest and most liquid stocks like Apple, Tesla, and Amazon. There is nothing wrong with these 2000; they are more than enough for many of us. If you want to stick with those a few of my favorite stock picking and data sources are Yahoo Finance, EDGAR and Magic Formula Investing Stock Screener.

Fortunately for me, my research led me to believe the lesser-known stocks are where the best investment ideas are. The problem with that was the lesser-known stocks required additional skills to access and were still unfamiliar to myself. I had to overcome a behavioral bias of mine called mere-exposure effect.

Mere-Exposure bias

In 2014 and 2015 I was familiar and confident with the pre-built tools, readily available data, and network I had with the subset of 2000 stocks. I didn’t understand that my instinct was to become complacent and satisfied as I became more and more familiar with the pre-built tools and few stocks that I was researching. What I now know is that the tendency I was feeling is related to our mere-exposure bias, a preference for familiarity. This isn’t only related to the stock data I gathered but in life. For example, when I went out to eat in Guatemala, I saw a burger on the menu, and I ordered it. But looking back and having the hindsight of tasting the burger, there were clearly healthier, cheaper, and better options available, but I chose the familiar burger.

New Languages, New Efficiencies, New Stocks

As I overcame mere-exposure bias and set out to expand my funnel of stocks I started hacking and hustling my way into larger and better data sets. That was an utter failure as it was unreliable, unsustainable and many times didn’t have the nano and micro-cap companies I really wanted to research. I eventually pivoted to learn the programming language Python. The pivot took 5+ years but now I can connect, gather and send stock data with Python, organize and store the data with SQLite, and then clean, calculate and visualize the data with the help of Data Analysis Expressions and Python. (If you want to learn Python too, my favorite learning resource is here).

Results

Overcoming my bias for the familiar and learning the foreign language of Python resulted in building a program that runs nightly and has expanded my stock picking universe from 2,000 to 42,280. Don’t worry, I’ve learned not to be complacent; Refinitiv estimates there to be more than 100,000 publicly traded stocks so I/we are not finished yet.

Leave A Comment