Have you ever dreamed of what you would do if you had too much money? I am not talking about dreaming of yachts, ponds full of hippos, and hanging with your entourage. I’m talking about your dreams of philanthropy, giving your neighbor a scholarship, stocking a food pantry, or funding a local psychiatric hospital.

If you aren’t there yet, stay on our plan of living below your means, saving and investing and you’ll be there sooner than you’d expect.

Some of our HIT Family is living out their philanthropic dreams and are supercharging them through tax protected charitable vehicles. Very few of us agree on which cause to support but almost all of us agree it is not the US government. Thus I did a deep dive on what I found to be our two best tax protected charitable vehicles, Private Foundations and Donor Advised Funds (DAFs).

Private Foundation or Donor Advised Fund (DAF)

Foundations and DAF’s are United States tax mitigation vehicles available to help us maximize our societal impact. Each has the same overarching goal but there are multiple nuances pending on each of your situations. I’d like to give out scholarships and invest in impact funds so I lean towards starting a Foundation, not a DAF. Which one will work best for you?

DAF and Foundation Goals

- Immediate tax benefits

- Tax free investment growth

- Future donations at your convenience

Primary Differences

- DAF’s are simpler and less expensive to set up

- DAF’s have less reporting and administrative requirements

- DAF’s are simpler to manage

- DAF’s do not have yearly required distributions (but Foundations do)

- When contributing to a DAF you can deduct more income

- Foundations are more flexible on what you can invest in

- Foundations are more flexible on what causes you can support

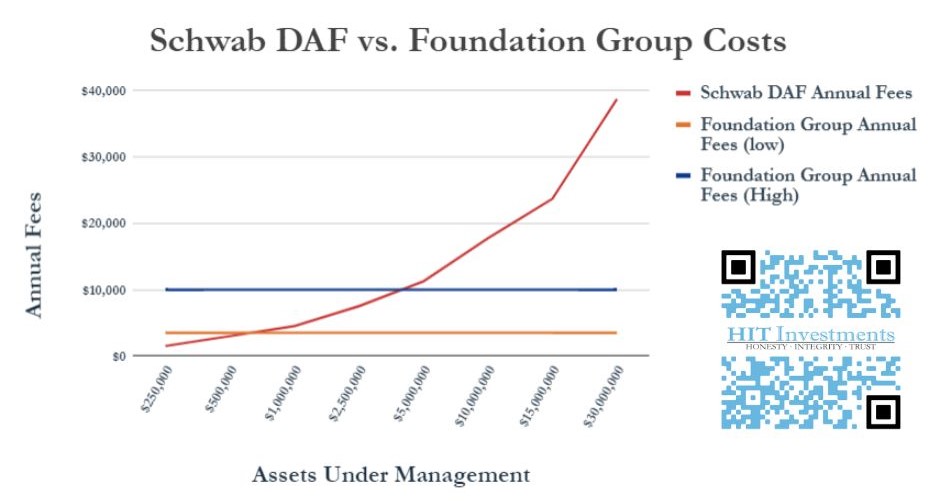

- Foundations are cheaper once you reach $5 million or more in charitable assets

- Foundations can convert to a DAF but a DAF cannot convert into a Foundation

Schwab DAF vs Foundation Groups Cost Comparison

Startup: Schwab DAF $0-100, Foundation Group $2450-6300

Ongoing Cost Comparison – See Chart Below

If maximizing your charitable assets is the primary driver, the Private Foundation is the better option once your charitable assets grow to a size of $5 million or larger.

DAF Donor Advised Fund and Foundation Details

DAF – Donor Advised Fund

A Donor Advised Fund (DAF), from a prospective donor’s standpoint, is a giving account already established in a public charity. The donors make a charitable contribution to the DAF and can receive an immediate tax deduction of up to 60% of their adjusted gross income. The DAF sponsor (established charity typically run by a large institution) ultimately has control over the donation but typically allows the donor to direct how the money is invested and ultimately granted. The DAF’s grant options are limited to organizations recognized as non-profits with proven public support and the investments are often limited to publicly traded diversified funds.

I expect the opportunities to widen as DAF’s become more popular.

Established DAF Sponsors: AEF, Fidelity, NPTrust, Schwab, T.Rowe Price, Vanguard, University Impact

Management

- The DAF organization has legal control while the donor retains advisory rights

Taxes

- Deductions: Up to 60% of adjusted gross income

Costs:

- $0-500 startup

- Ongoing Fees: 0.05-0.85% of AUM

Contributions, Investment Options, Grants

- Contributions and Investments are limited to what sponsors approve. Typically they include cash and publicly traded securities.

- There is no option to donate or grant to individuals i.e. scholarships

Private Foundation

A private foundation is a 501c3 charitable entity that an individual, family, or group of donor(s) can set up and (or) contribute to. Private foundations have more flexibility and control on what contributions are acceptable, what they can invest in and what the funds can be used for but with the added flexibility comes additional setup cost, maintenance and complexity.

Management: Board of Directors of foundations choosing

Taxes

- Deductions: Up to 30% of adjusted gross income when cash and 20% of adjusted gross income when an appreciated asset.

- 1.59% excise tax on investment growth

Costs:

- $2450-6300 startup costs: includes $600 1023 IRS Form, $1500 990PF Annual Report, State Registration $8-200, fundraising filing and FTB franchise tax exemption filing

- $6000/yr ongoing fees – includes Bookkeeping $3588-5988 and $1500 for 990pf annual report filing.

Contributions:

- Public and Private Securities

- Short and Long Equity Positions

- Alternative Investments i.e. Hedge Funds, Private Equity, and Venture Capital

Investment Options

- Full Universe (need to check IRS stipulations to further describe)

Grant & Use Options

- Charities

- International Missions

- Direct Charitable Activities i.e. Scholarships

- Provide Charitable Services

- Annual distributions (grants, uses, expenses) must exceed equal or exceed 5% or more of the foundations preceding year’s value

Miscellaneous

- No public oversight, all in 990pf end of year report to IRS

- Minimum of 3 board members

- Disqualified persons cannot receive income from the foundation

- Expert help sources: Foundation Group, Foundation Source

Leave A Comment