Personal Finance

Personal Finance: Seven Things We Learned From The Flood

As Hurricane Harvey began to move East so did the waters gathered in the reservoirs North and West of our home. After 4 days of torrential downpour the hurricane had moved on. The sun was shining. Then we fl......

19 Reasons to Eliminate Debt

1. Happiness The overarching reason why we want to become debt free is that it can lead to increased happiness. Here are 18 reasons for getting out of debt and how it can lead to a happier life: 2. Complexity Eliminating debt reduces the complexity of your monthly finances. No debt, means no more: tracking home mortgage interest in preparation for taxes, worrying if your adjustable interest rate will go up, and ensuring your loan payments are sent on time. 3. Stress The burden of borrowing and having to pay someone back is taxing on your mental health. Proverbs 22:7 [...]

The Top Bargain Hunting Site

With the shopping season upon us, let me introduce you to one of HIT Investments’ favorite deal sharing sites: Slickdeals. Slickdeals has over a million active members submitting, commenting, and ranking products they believe are selling at a discount. The members (myself included) and editors create an online shopping ecosystem that results in a never ending stream of product deals from reputable merchants. If you are looking for Christmas gift ideas, scroll through the front page deals. The front page deals are products from merchants that have made it through the gauntlet of community rankings, comments, and editors' reviews. Let [...]

The Mailbag: 4 Steps to Improve Your Savings

The steady stream of questions and comments from interested readers has led me to the creation of a new HIT Investments Series: The Mailbag. Since I write for you, I might as well write about what interests you. The mailbag will be a recurring piece that responds to your questions, comments, and concerns. There will be no magic formula regarding what topics are covered. It may be that many of you are interested in one topic or it may be that one of you poses an interesting question or thoughtful comment. With that in mind, here we go: Q: I [...]

How to Make Money Work For You In 3 Simple Steps

While your savings rate gets you to the playoffs (the race for retirement), making it grow will win you the championship of financial freedom! That's why it's crucial that you learn how to make money work for you. A great way to grow your money is to invest a portion of it in the market, whether that be through stocks, bonds, real estate, ETF’s, mutual funds, or something else you believe will gain a positive return. Whenever investment professionals reference the idea of “making money work for you”, they are referencing the concept of investing your money in productive assets. [...]

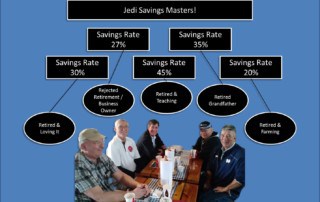

The Crave to Save, or Lack Thereof

If you are even remotely thinking about retirement, our guess is that you have heard a number of vastly differing opinions on what decisions will most impact the age at which you can retire. The primary lifestyle decision is whether you are, or going to become, a saver. The benefits that savers experience over the spenders and the borrowers are vast, “5 reasons to live below your means” can give you a glimpse of a few of those benefits. This may be a bit of a surprise coming from a hedge fund manager at HIT Investments, but your investment portfolio [...]