When I first wrote about the mental model for purchases I did not imagine that my own personal case study would follow. But then again, who would have thought Hurricane Harvey was going to bring more than 60 inches of rainfall. That volume of rain shattered the previous record by more than 12 inches!

It has now been almost 600 days since thirteen of those inches found their way into our home and our entire first floor was destroyed. Since being rescued on August 30th, 2017, we have demolished, dried, rebuilt, and since moved back into our home. The experience was full of financial risks and opportunities.

One opportunity was the ability to test the mental purchasing model by applying it to the purchasing decisions we made while rebuilding our home. Having been blessed with flood insurance, we had a natural control point and estimate of what it should cost to bring our home back to a pre-flood state. Now that we are complete, expenses are paid, and insurance has paid out, how did the mental purchasing model do?

Step 0 – Need vs. Want

This step was quick, as staying with friends was not a long-term option and we needed a safe place to live. We thought about buying a new home and selling the flooded one (quick decision quality analysis) but ultimately chose to rebuild.

Step 1 – Define What You Need

While the studs dried, my wife and I came to the conclusion we were in need of professional help. Neither of us had extensive remodeling experience; thus it became pertinent to find someone with expertise and the flexibility to incorporate our rebuild vision. The single most important decision in the remodel process was who we chose as our primary contractor.

Step 2 – Research

During the research stage we moved back and forth between step 1 and 2; as we gathered information and learned more about remodeling we further defined our contractor needs. Typically, the brunt of research is done online but in this situation we found the internet to be a bust. Personal referrals, references, and word of mouth were our primary sources of information. Once we had a nice list of potential contractors, we set up interviews to learn more about their process, plan, expertise, and ultimately price. The interview process brought us through step 1, 2, and into step 3.

According to our research in step 2, we wanted the qualities in our contractor to be competent, flexible, cost-effective, and a willingness to partner with us.

Step 3 – Quality and Price.

Steps 2-4 are where the mental purchasing model found its stride. Being in the middle of the worst flood in the history of the United States, the interview process exposed an expansive spread of available price and quality. The price range ran from $40,000 to $250,000 and the contractors ranged from salesman to skilled laborers. The interesting piece was price did not necessarily correspond to quality. Hiring a contractor in the middle of a disaster zone brought opportunity for many to prey on the emotional stress and chaos of those who flooded.

Our best interviews came from contractors found through personal referrals and not from direct marketing or the internet. Due to the internet continuing to be a bust we adjusted our quality research and reviewed examples of the contractor’s previous work, gathered references and focused additional effort on aligning our interests in Step 4 (Making the Deal).

Before moving on to making a deal we narrowed down the contractors to our top 2 candidates. They met all our criteria from step 2. They were both local, competent, flexible, cost-effective and came highly recommended.

Step 4 – Making the Deal

Between the finalists, we did a bit more negotiation around the price and flexibility. Step 4 was set up by step 3 through having the contractors provide a detailed proposal after their interview. It was easier to negotiate specific line items on the proposals than to negotiate the price in its entirety.

Alongside price, we negotiated in flexibility and a payment plan. Flexibility meant we can use the purchasing model on the largest and most material purchases throughout the rebuild. The industry norm is for contractors to have control and for the homeowner to pay for material +10% through the contractor or for the contractor to add a 15-20% buffer in the upfront price. We later found the contractor material costs to be around a 50% price increase when compared to the purchasing model results.

The second item we negotiated in after flexibility was a payment plan. This was a quality and risk mitigation strategy in case we missed something in step 2 and 3. At the time, negotiating a payment plan in was difficult but in the end, was worth it. An additional benefit to having the payment plan and a detailed proposal was the flexibility to hire out projects if the contractor got too busy or we found a deal that was mutually beneficial.

Steps 1-4 took us about 2 weeks and were done while the wood was drying from the flood.

Step 5 – Paying the Man

Soon work was commencing, and our payment plan was in effect. We preferred to use our 2% cash back credit card to pay all bills and e-commerce cash back affiliate links when shopping online. The contractors only accepted payment by check but as we purchased materials along the way the results of using cash back tools came to fruition. By the end, we clawed back $57 through Mr. Rebates and $884 through Fidelity’s 2% cash back credit card.

Throughout the payment process, we were thankful for having an emergency fund. If we hadn’t been prepared, we would have been delayed for more than 5 months. By the time our insurance adjuster arrived for an inspection, we were already 99% complete.

600 Days Later – The Conclusion

It is 600 days later, the work is complete, the expenses are paid, and insurance has paid out. The insurance not only re-filled our savings account, but it also gave us a control figure to evaluate how our mental purchasing model faired. According to the insurance adjuster, the payments are based on the average cost to return our home to its pre-flood state. (If you are in insurance we would love to learn if this is true or a negotiating tactic?)

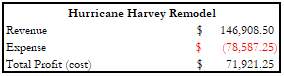

The Winner… Mental Purchasing Model vs Insurance

The actual costs to remodel and replace our first floor with similar or improved materials was $78,587. It may have taken another 5 months for insurance to pay out but when it did it was for a total of $144,540! So, what initially looked like a financial disaster turned into a financial tailwind. Combining the cash back rewards with the insurance payout brought us to almost $147,000 in revenue.

Subtracting out our $78,587 in expenses we ended up saving a total of $71,921!

There is no doubt the mental purchasing model took additional time and effort, but looking back we are happy to have used it.

Is it worth your time to learn a few mental models? If so, why not start with the mental purchasing model. What big purchases do you have coming in your future? Maybe it’s not a big house remodel, perhaps the purchase of a car, further schooling, or planning a big celebration such as a wedding or reunion?

For the detailed oriented followers, or the fix and flip connoisseurs there will be a future post for you. It will contain before and after photos along with the ledger with all re-model costs, cash back, and insurance payments. Don’t miss it, sign up for the HIT Investments newsletter here 😊

References

Record storm rainfall – Wikipedia

The insurance adjuster came in, assessed the value of the loss, and then cut the check. So that’s essentially saying the same thing as returning the home to its pre-flood state, and it’s probably based on actuarial tables, although I’m not sure if it’s averages versus some other actuarial formula.