In my last post, I connected an increase in anxiety with the additional choices and freedom brought on by financial independence. Thanks to Barry and Danielle’s insights I was able to take a step back and see what was happening inside my head, Choice Overload.

I have a natural tendency to maximize every decision, and when I face multiple decisions at once it leads to decision deferral, and decision fatigue. While in my mind I was trying to do great things, in reality I was like the baby above, doing nothing but sticking my foot in my mouth.

Once I understood the causes of choice overload, how did I eliminate it? I stopped maximizing, decision deferral, and decision fatigue by implementing the following 6 step plan.

6 steps to conquer choice overload

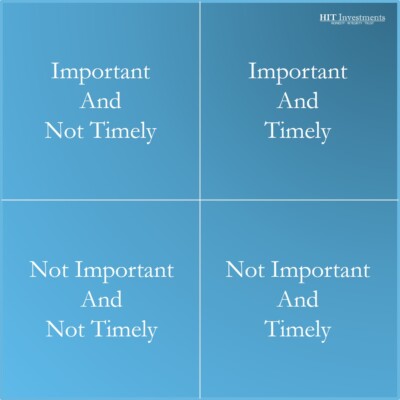

- Separate the important decisions from the trivial

- Separate the timely decisions from the untimely

- Prioritize the decisions based on importance and time

- Important and Timely

- Important and Untimely

- Timely and Trivial

- Untimely and Trivial

- Work one decision at a time

- Don’t overwork (maximize) trivial decisions

- Keep money in the decision making process

Separating the important decisions vs trivial

Most of the decisions we make each day are trivial and do not need to be maximized, for instance the toothpaste I purchase is not important. If the decision is not going to have a dramatic effect on my or others’ wellbeing, I move it into the trivial bucket. The following is an example of how Sarah and I bucketed the decisions we had in front of us.

Important and Timely

Important and Timely

- Should I retire? – Option for severance made this decision timely

- Should we purchase health insurance?

- What health insurance should we purchase?

- Should our boys start kindergarten next year?

Important and Not Timely

- Where should we live?

- Should I take the lump sum or annuity?

- When and for how long should we visit family?

- What additional HIT Investment Projects should I take on?

- What car and home insurance do we purchase?

Timely and Trivial

- What variety of carrots should I plant?

- Which rear hub on my bike to purchase?

- How often should I attend the kids’ swim practice?

Trivial and Not Timely

- How often should the landscaping be watered?

- Where should www.hitinvestments.com be hosted?

- Should I become a coffee and craft beer connoisseur?

- Is whole fruit coffee worth the effort and cost vs k-cup?

- What toothpaste, shampoo, and soap should I buy?

Results

Bucketing the decisions helped us prioritize and initiate the process of working through one important and timely decision at a time. A few of the results were:

- Retire from ConocoPhillips – Yes

- Health Insurance – no

- Type of Health Share Plan – Basic cost share plan, Samaritan

- Kindergarten or Pre-K – One more year of pre-k

- Pension Lump Sum or Annuity – Lump sum

- What Additional HIT Investment Projects

- 10 Separately Managed Accounts

- 1 Value and Momentum Stock Screener

- Form/Join Private Investment Club

- Research Tax Advantaged Charitable Investment Entities

- Toothpaste – Arm and Hammer Baking Soda (just kidding on the important part, I went back to Slickdeals and found a pack of 6 for the price of 1.5)

As for the important but not timely decisions, we are presently figuring out “how often and long we should visit family”. When I started this post, we were visiting my in-laws. Figuring out the optimal time to visit will help guide our upcoming decision on where we choose to live.

Conclusion

Organizing our choices into what is important, taking them one by one, and keeping monetary value in the decision making process has reduced if not eliminated our anxieties caused by Choice Overload. An added perk to reducing my own tendency to maximize is a more harmonious relationship with my wife. We get to spend more time enjoying each other rather than arguing over trivial decisions. Many thanks to all those involved in helping lessen my anxiety and improve my marriage. It has been fun to conquer choice overload, and I hope if you are suffering from something similar this will help you conquer your own choice overload stressors.

Bring on the financial independence adventures, (I think) we are ready!

References

The featured image is a photo of my adventurous sister who just made a big decision. She purchased her first home last week.

The cartoon was created by John McNamee

Important and Timely

Important and Timely

Just a typo: fix your quadrant labels.

Thanks for the catch @Arsham. quadrant labels have been updated