My Alternative to Expensive Insurance

When reviewing health share plans we were drawn to Samaritan, which has been around since 1994. Samaritan describes themselves as “A community of Christians paying one another’s medical bills.” This is exactly what it is, those of us who signed up to be a part of this plan do not have insurance, and are committed to sending their monthly share to another Christian in need.

Samaritan is based in Peoria, IL. That means it’s just over the river from us, and there are many people around our area that are familiar with this medical sharing plan. In fact, when I go to the doctor and tell them I don’t have insurance, they immediately assume I use Samaritan.

Noticeable Differences

As we began researching Samaritan there were some noticeable differences from insurance that were eye opening. Here are a few costs that are NOT shareable:

- Pre Existing medical conditions (which means that you have had a symptom, treatment or medication to treat your condition in that last 12 months, or other major conditions like cancer or heart conditions must be 5 years of no symptoms or treatments)

- Preventative or Routine Care

- The first $400 of each need

- If the need for one condition exceeds $250,000

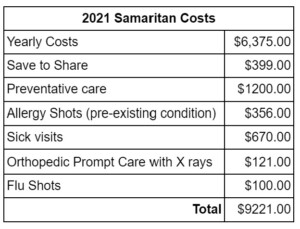

Number 4 was a deal breaker for us. We know friends who have experienced unforeseen illnesses or accidents, and their cost exceeded 250,000. But as we dug in further we found Samaritan has a program called “save to share,” that we can opt into for needs greater than $250,000. We chose to participate in that plan which means we set aside $399 per year, to be paid out when the need arises.

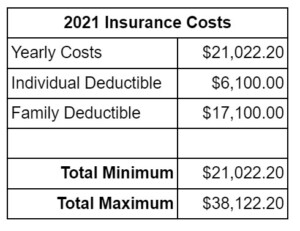

Cost Comparison

We looked at the cost of insurance, copays and out of pocket max, and compared that to Samaritans, the monthly share costs plus the cost of preventative care. We added in a couple more visits to the emergency room or urgent care for the smaller things that tend to happen more regularly like broken bones, allergic reactions or ear infections. Lastly, we thought about the scenario of a catastrophic health event like cancer, or any other medically expensive life altering event.

Here’s a comparison chart of the payments we’ve made this year vs. what we may have paid for insurance. I doubt I need to tell you how complicated insurance is and the surprises that can come with it. For instance, you may have hit your insurance deductible for the year, and then all the sudden you are sent a bill and find out urgent care visits weren’t covered. So for comparisons sake I’m simplifying some things in this chart.

I used to teach physics to high schoolers before retiring to focus on my family. I will share a glimpse of where I found joy during this season, since it applies here as well. It was in teaching them the process of problem solving; rechecking their answers by asking “does this make sense?.” It was rewarding when I knew my students would no longer need me to find their own solutions.

Thought Process

Here’s how my thinking went:

- If we are completely healthy with no medical needs other than our preventative exams and flu shots we would pay close to $8,000 with Samaritan. (With insurance we would pay $21,000).

- If we went with insurance and hit our out of pocket max, we would pay $38,000.

This means we would need to spend another $30,000 on other medical needs that are not related to each other at all, in order for Samaritan to be worth it. If each non related medical need is $400 out of pocket from Samaritan, we would need to have over 75 different non related medical problems for insurance to be the better deal.

Do you know how many weeks there are in a year? A little over 52. Can you imagine taking yourself or a family member to the doctor more than once a week for medical issues that are not related to each other?

That calculation alone made us feel confident in our choice to go with Samaritan and a health share plan.

A couple more thoughts to consider

Something we’ve learned by participating in Samaritan, is that when you are paying out of your pocket for medical bills, you aren’t charged the same amount that you see insurance companies covering on your bills. For example I just got a bill from the OBGYN for $880, this bill was for a routine checkup, and an ultrasound ordered by the doctor at that appointment. I called and asked for a self pay discount. Guess how much I actually paid? $350.

If you think a medical cost sharing plan is right for you, start by doing your own deep dive on the specific plan and make sure everything your family needs or may need is calculated into your comparison. We went with Samaritan, but you may not be a Christian or have other reasons to choose differently. I found this comparison site helpful when shopping around for the best health share plan. It’s important to do your own research as each health share plan is different and some things normally covered by insurance will become your responsibility. As long as you figure the differences into your decision and monthly medical budget, it still may be wise for you to switch.

Below are a few areas we have learned through the process that are not shareable with Samaritan.

- Social counseling

- Speech therapy

- Addiction recovery

- Pre existing conditions

- Abortion

- Abuse of alcohol or illegal drugs

- Infertility expenses

I hope you found this useful. Since I am not a health share plan expert, but just a normal person looking for the best way to avoid unnecessary health care costs, I’ll end with a disclosure. This post is in no way sponsored or endorsed by Samaritan but is based upon my own research and experiences. If you have specific questions about a plan you should reach out to that specific organization. If you would like to know more about my family’s experience I would be happy to share with you. Just leave a comment on our website at the bottom of the blog, send me an email, or give me a phone call.

Leave A Comment