Is the credit card the cigarette of the stacker’s world? Dave Ramsey certainly thinks so.

Stacker Myth or Stacker Truth

Cutting up credit cards may help some people avoid temptation, but for a stacker it could cost us hundreds of thousands of dollars. If the temptation to spend more is not a problem the cash back credit card becomes a tool to be used, not a burden to be broken. We can use a credit card to pay for our necessities, build credit, give cash back, prevent fraud, provide convenience, and earn interest.

To put Dave’s advice into perspective, I looked at my credit card expenses last month and calculated what I’d lose if I followed his advice for the next 25 years. I could hardly believe my eyes……….

$193 Cash Back In Just One Month

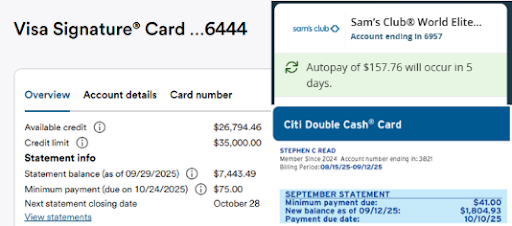

Last month, my wife and I spent $7,443 on our Fidelity Visa cash back card, $1,804 on our Citi Double Cash Back business card and $157.56 on our Sam’s Club gas card, totaling $9440. Fidelity and Citi give us 2% cash back and the Sam’s Club card 5%. This resulted in $193 of cash back, fraud protection, and the convenience of leaving my cash, check book, and credit cards at home (I use Google Pay).

$41 Interest

The credit card benefits don’t end there, because I charged $9,440 but the money didn’t leave my cash management account for 40 more days. In that timespan I earned an additional $41 in interest from the money sitting in my cash management account earning 4% interest.

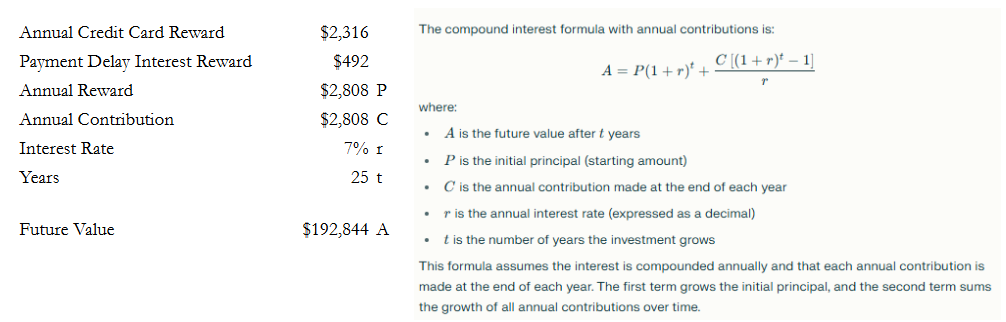

$2,808 Per Year

So I received $192 in cash back and earned $41 in interest totaling an additional $234 last month, just for using my credit cards. If I annualize that, it comes out to $2,808 per year.

$192,844 In 25 Years

So being a stacker, I plan on doing this for the next 25 years. Investing that $2,808 each year with an estimated 7% annual return, my credit card rewards come out to a 25 year value of $192,844.

Cash Back and Stack!

Let Dave do Dave. We will Stack and Cash Back!

Leave A Comment